Your Family's Legacy

Deserves More Than

Paperwork.

Discover how the Legacy Ladder™ + AI-powered planning secures your future.

Free 20-min review

No Obligation

Instant Legacy Guide

Your Family's Legacy

Deserves More Than

Paperwork.

Discover how the Legacy Ladder™ + AI-powered

planning secures your future.

Free 15-min review

No Obligation

Instant Legacy Guide

Meet Lawrence Haynes, Your Legacy Expert

Watch this 90-second video to understand how the Legacy Ladder™ transforms family protection.

⏱️ 90 seconds that could save your family's future

Meet Lawrence Haynes, Your Legacy Expert

Watch this 90-second video to understand how the Legacy Ladder™ transforms family protection.

⏱️ 90 seconds that could save your family's future

Don't Let These Common Mistakes

Put Your Family at Risk

Most families are under protected without realizing it.

Here are the 3 biggest gaps we see:

Outdated Coverage

Your life has changed, but your insurance hasn't. Marriage, children, new home, career growth - your coverage needs to evolve with you.

Rising Costs

Insurance premiums keep climbing while coverage stays the same. You're paying more for protection that may no longer fit your needs.

Unprepared Family

Without proper planning, your family could face financial hardship. Don't leave their future to chance when you can secure it today.

The Solution is Simple

A quick 15-minutes review can identify gaps, reduce costs, and ensure your family is properly protected. It's free, with no obligation.

Don't Let These Common Mistakes

Put Your Family at Risk

Most families are under protected without realizing it.

Here are the 3 biggest gaps we see:

Outdated Coverage

Your life has changed, but your insurance hasn't. Marriage, children, new home, career growth - your coverage needs to evolve with you.

Rising Costs

Insurance premiums keep climbing while coverage stays the same. You're paying more for protection that may no longer fit your needs.

Unprepared Family

Without proper planning, your family could face financial hardship. Don't leave their future to chance when you can secure it today.

The Solution is Simple

A quick 15-minutes review can identify gaps, reduce costs, and ensure your family is properly protected. It's free, with no obligation.

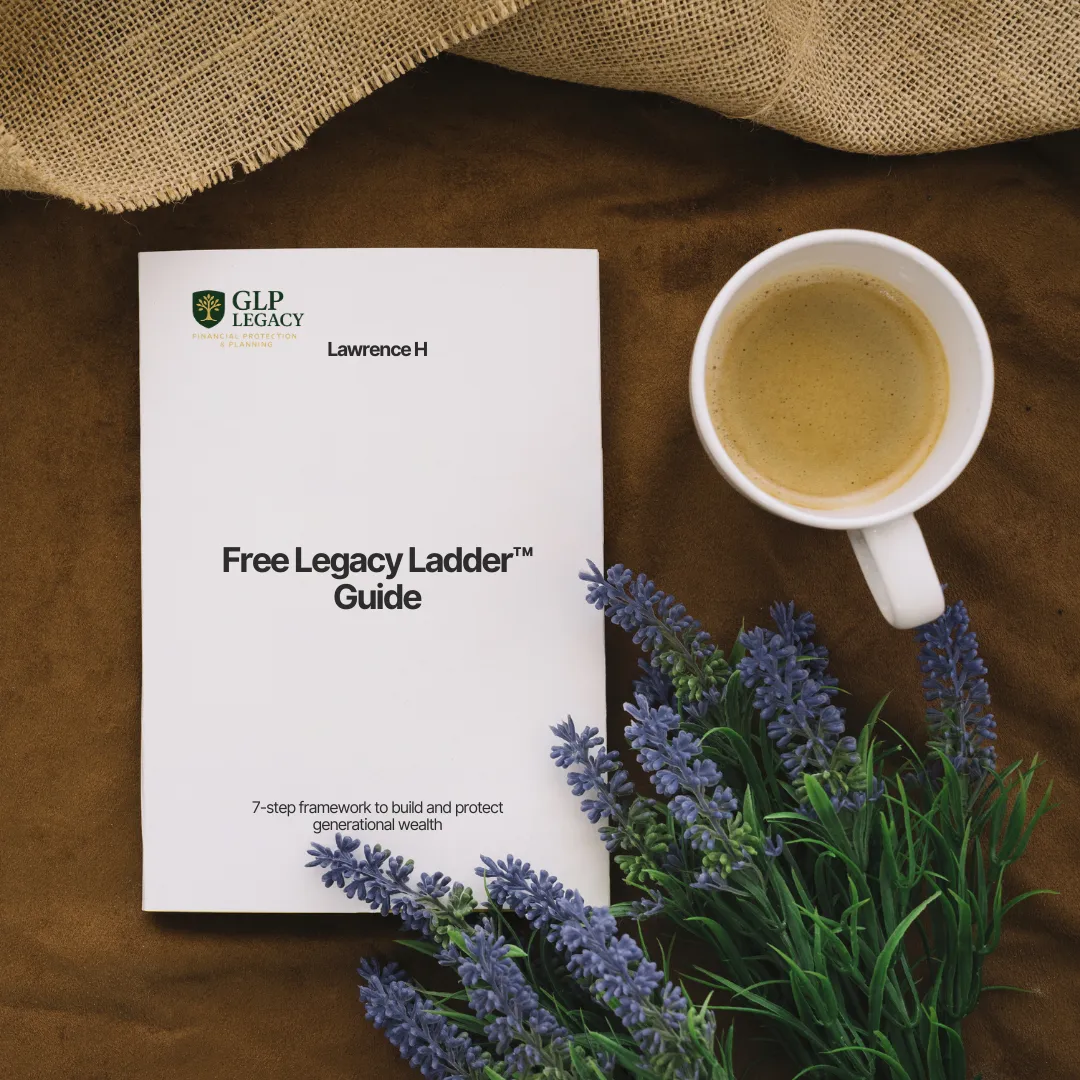

Get Your Free Legacy Ladder™ Guide

Discover the 7-step framework to build and protect

generational wealth

What You'll Get

7-step wealth protection framework

Insurance gap analysis checklist

Estate planning essentials guide

Tax optimization strategies

Family wealth transfer blueprint

Get Your Free Legacy Ladder™ Guide

Discover the 7-step framework to build and protect generational wealth

What You'll Get

7-step wealth protection framework

Insurance gap analysis checklist

Estate planning essentials guide

Tax optimization strategies

Family wealth transfer blueprint

Secure Your Family’s

Future in 15 Minutes

Choose a time that works best for you. In just 15 minutes, we’ll review your current coverage, identify hidden gaps, and show you simple ways to protect your legacy. No cost, no pressure, just clarity and peace of mind.

What You'll Get

7-step wealth protection framework

Insurance gap analysis checklist

Estate planning essentials guide

Tax optimization strategies

Family wealth transfer blueprint

Secure Your Family’s Future in 15 Minutes

What You'll Get

7-step wealth protection framework

Insurance gap analysis checklist

Estate planning essentials guide

Tax optimization strategies

Family wealth transfer blueprint

What You'll Get

7-step wealth protection framework

Insurance gap analysis checklist

Estate planning essentials guide

Tax optimization strategies

Family wealth transfer blueprint

Why Families Choose GLP Legacy

Premium, AI-powered family wealth protection designed for

modern families and entrepreneurs.

Why Families Choose

GLP Legacy

Premium, AI-powered family wealth protection designed for

modern families and entrepreneurs.

The Legacy Ladder™ Process

The GLP Legacy Ladder™ is a simple, step-by-step path designed to uncover hidden risks, align your coverage, and give your family lasting peace of mind.

Each stage builds on the last, from audit to roadmap, ensuring clarity, confidence, and protection at every step

The Legacy Ladder™ Process

The GLP Legacy Ladder™ is a simple, step-by-step path designed to uncover hidden risks, align your coverage, and give your family lasting peace of mind.

Each stage builds on the last, from audit to roadmap, ensuring clarity, confidence, and protection at every step

Concierge-Level Support

Premium, done-for-you guidance with clarity,

compassion, and confidence.

AI-powered plan review

Estate & protection gaps identified

Optimized coverage recommendations

Family Wealth Blueprint PDF

Concierge-Level Support

Premium, done-for-you guidance with clarity, compassion, and confidence.

AI-powered plan review

Estate & protection gaps identified

Optimized coverage recommendations

Family Wealth Blueprint

Why should you work with

Lawrence Haynes

Has access to a broad array of insurance companies and products and can help you with a variety of insurance needs, including final expense, mortgage protection, retirement planning, and more.

Expertise

Lawrence is a trained professional who has a deep understanding of the different types of life insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

An Advisor can be more convenient than trying to research and compare policies all on your own. Lawrence can do the legwork for you, comparing quotes from multiple insurance companies and helping you understand the terms and conditions of each policy.

Personalized service

An Advisor can provide personalized service and support to help you choose the right policy for your unique situation. They can take the time to understand your financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

Why should you work with

Lawrence Haynes

Has access to a broad array of insurance companies and products and can help

you with a variety of insurance needs, including final expense, mortgage protection, retirement planning, and more.

Expertise

Is a trained professional who has a deep understanding of the different types of life insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

An Advisor can be more convenient than trying to research and compare policies all on your own. Lawrence can do the legwork for you, comparing quotes from multiple insurance companies and helping you understand the terms and conditions of each policy.

Personalized service

An Advisor can provide personalized service and support to help you choose the right policy for your unique situation. They can take the time to understand your financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

See How We've Helped Families Like Yours

Every legacy we safeguard starts with families

like yours built on love and purpose.

“GLP Legacy helped us protect everything we’ve worked

for, now our family’s future feels secure.”

- Sarah & Mike Johnson

Special Offer

Schedule your consultation within 48 hours of watching this video and receive a complimentary Estate Planning Quick-Start Guide (normally $97).

See How We've Helped Families Like Yours

Every legacy we safeguard starts with families like yours built on love and purpose.

“GLP Legacy helped us protect everything we’ve worked for, now our family’s future

feels secure.”

- Sarah & Mike Johnson

Special Offer

Schedule your consultation within 48 hours of watching this video and receive a complimentary Estate Planning Quick-Start Guide (normally $97).

What Families Are Saying

What Families Are Saying

Frequently Asked Question

Clear Answers for Your Family’s Financial Future

What is the Legacy Ladder™ and how does it work?

The Legacy Ladder™ is our step-by-step process to secure your family’s future. It includes a risk audit, a custom legacy blueprint (wills, trusts, and insurance alignment), a 1:1 strategy session, and a clear roadmap for implementation.

Do I have to take a medical exam to qualify for coverage?

Not always. Some policies require a basic medical exam, while others can be approved based on your health history and application details. We’ll help you find the option that best fits your situation.

Can I update or change my policy later?

Yes. Life changes — marriage, children, a new home, or business — can all affect your coverage needs. We regularly review policies with our clients to ensure they remain relevant and effective.

How does working with GLP Legacy differ from buying insurance online?

Unlike one-size-fits-all policies, we provide personalized consulting backed by 25+ years of experience. Our focus is not just selling a policy but protecting your wealth, reducing costs, and creating a lasting legacy for your family.

What types of life insurance do you offer?

We offer a variety of life insurance options, including term life, whole life, universal life, final expense, and indexed universal life (IUL). Each is designed to meet specific needs, whether you're looking for temporary coverage, long-term planning, or investment opportunities.

How much life insurance coverage do I need?

Your coverage needs depend on your income, debts, living expenses, and future financial goals. We can guide you through a needs analysis to determine the right amount of coverage for your family and budget.

Can I access the cash value of my life insurance policy?

Yes! Some policies, like whole life and indexed universal life, build cash value over time that you can access through loans or withdrawals. This can be a great resource for unexpected expenses or financial planning.

What happens if I miss a premium payment?

Many policies have a grace period, typically 30 days, during which you can make your payment without losing coverage. If you think you’ll have trouble making a payment, contact us as soon as possible to discuss your options.

Frequently Asked

Question

Clear Answers for Your Family’s

Financial Future

What is the Legacy Ladder™ and how does it work?

The Legacy Ladder™ is our step-by-step process to secure your family’s future. It includes a risk audit, a custom legacy blueprint (wills, trusts, and insurance alignment), a 1:1 strategy session, and a clear roadmap for implementation.

Do I have to take a medical exam to qualify for coverage?

Not always. Some policies require a basic medical exam, while others can be approved based on your health history and application details. We’ll help you find the option that best fits your situation.

Can I update or change my policy later?

Yes. Life changes - marriage, children, a new home, or business can all affect your coverage needs. We regularly review policies with our clients to ensure they remain relevant and effective.

How does working with GLP Legacy differ from buying insurance online?

Unlike one-size-fits-all policies, we provide personalized consulting backed by 25+ years of experience. Our focus is not just selling a policy but protecting your wealth, reducing costs, and creating a lasting legacy for your family.

What types of life insurance do you offer?

We offer a variety of life insurance options, including term life, whole life, universal life, final expense, and indexed universal life (IUL). Each is designed to meet specific needs, whether you're looking for temporary coverage, long-term planning, or investment opportunities.

How much life insurance coverage do I need?

Your coverage needs depend on your income, debts, living expenses, and future financial goals. We can guide you through a needs analysis to determine the right amount of coverage for your family and budget.

Can I access the cash value of my life insurance policy?

Yes! Some policies, like whole life and indexed universal life, build cash value over time that you can access through loans or withdrawals. This can be a great resource for unexpected expenses or financial planning.

What happens if I miss a premium payment?

Many policies have a grace period, typically 30 days, during which you can make your payment without losing coverage. If you think you’ll have trouble making a payment, contact us as soon as possible to discuss your options.

Free Consultation

Free Consultation

Meet the Team That Makes It Happen

Daniel Kim

Daniel oversees operations and ensures every part of the business runs smoothly. With a strong background in process management, he’s the connection point between leadership’s vision and day-to-day execution.

Chief Operating Officer (COO)

James Whitaker

James manages budgets, reporting, and long-term financial planning. With deep expertise in strategic allocation, he ensures resources are invested wisely, balancing growth opportunities with stability to keep the company financially strong.

Chief Operating Officer (COO)

Vanessa Cole

Vanessa defines the company’s overall vision and strategic direction. Known for her ability to inspire confidence, she leads client relationships and guides internal teams toward shared goals, sustainable growth, and long-term success

Managing Director

Sophia Grant

Sophia leads branding, outreach, and client engagement. She makes sure the company’s message is consistent, compelling, and connects clearly with the audiences it serves across every channel and touchpoint.

Marketing & Communications Lead

Marcus Ellis

Marcus leads new initiatives and builds strategic relationships that fuel expansion. He focuses on aligning market opportunities with the company’s direction, ensuring growth efforts directly support long-term stability and success.

Head of Strategy &

Partnerships

Our team is here to make sure you succeed.

Join 500+ Families Who've Secured Their Future

Your family's financial security is too important to leave to chance.

Start with a free 15-minutes consultation.

Meet the Team

That Makes It Happen

Daniel Kim

Daniel oversees operations and ensures every part of the business runs smoothly. With a strong background in process management, he’s the connection point between leadership’s vision and day-to-day execution.

Chief Operating Officer (COO)

James Whitaker

James manages budgets, reporting, and long-term financial planning. With deep expertise in strategic allocation, he ensures resources are invested wisely, balancing growth opportunities with stability to keep the company financially strong.

Chief Operating Officer (COO)

Vanessa Cole

Vanessa defines the company’s overall vision and strategic direction. Known for her ability to inspire confidence, she leads client relationships and guides internal teams toward shared goals, sustainable growth, and long-term success

Managing Director

Sophia Grant

Sophia leads branding, outreach, and client engagement. She makes sure the company’s message is consistent, compelling, and connects clearly with the audiences it serves across every channel and touchpoint.

Marketing &

Communications Lead

Marcus Ellis

Marcus leads new initiatives and builds strategic relationships that fuel expansion. He focuses on aligning market opportunities with the company’s direction, ensuring growth efforts directly support long-term stability and success.

Head of Strategy &

Partnerships

Our team is here to make sure you succeed.

Join 500+ Families Who've Secured Their Future

Your family's financial security is too important to leave to chance.

Start with a free 15-minutes consultation.

Socials

GLP Legacy follows applicable insurance marketing and A2P messaging guidelines. SMS consent is required for reminders and updates. Privacy protected.

© 2026. All rights reserved,

Socials

GLP Legacy follows applicable insurance marketing and A2P messaging guidelines. SMS consent is required for reminders and updates. Privacy protected.

© 2026. All rights reserved,